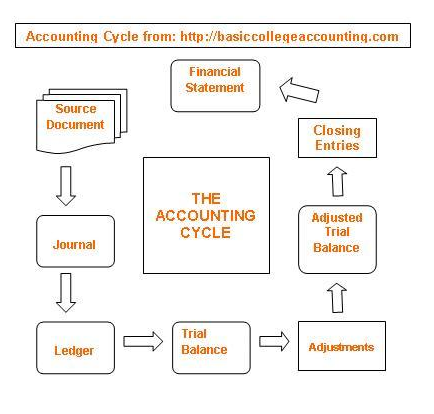

This trial steadiness encompasses solely the everlasting accounts, which include assets, liabilities, and equity accounts. It serves to verify that debits and credits are equal, thus guaranteeing the books stay Nine Steps In The Accounting Cycle balanced following the closure of short-term accounts. The balances within the temporary accounts are closed or reduced to zero and the online earnings or loss is transferred to the capital accounts to arrange for the subsequent financial accounting interval.

Step 8 – Create Monetary Statements

Accountants use it to detect discrepancies, making certain all transactions are recorded accurately. For instance, if your Money account shows $5,000 and your Accounts Payable shows $2,000, the trial balance should verify these figures match via proper debit and credit score entries. On the other hand, credit indicate increases in liabilities and equity and decreases in belongings and bills.

Choose Sturdy Accounting Software Program

- For example, The Personal Bills of owners or loans usually are not considered to be recorded in guide of accounts.

- Thus, the companies put together a worksheet to trace the errors in the report.

- For example, linking sales knowledge from CRM to accounting software allows the automated creation of invoices and updates to revenue records.

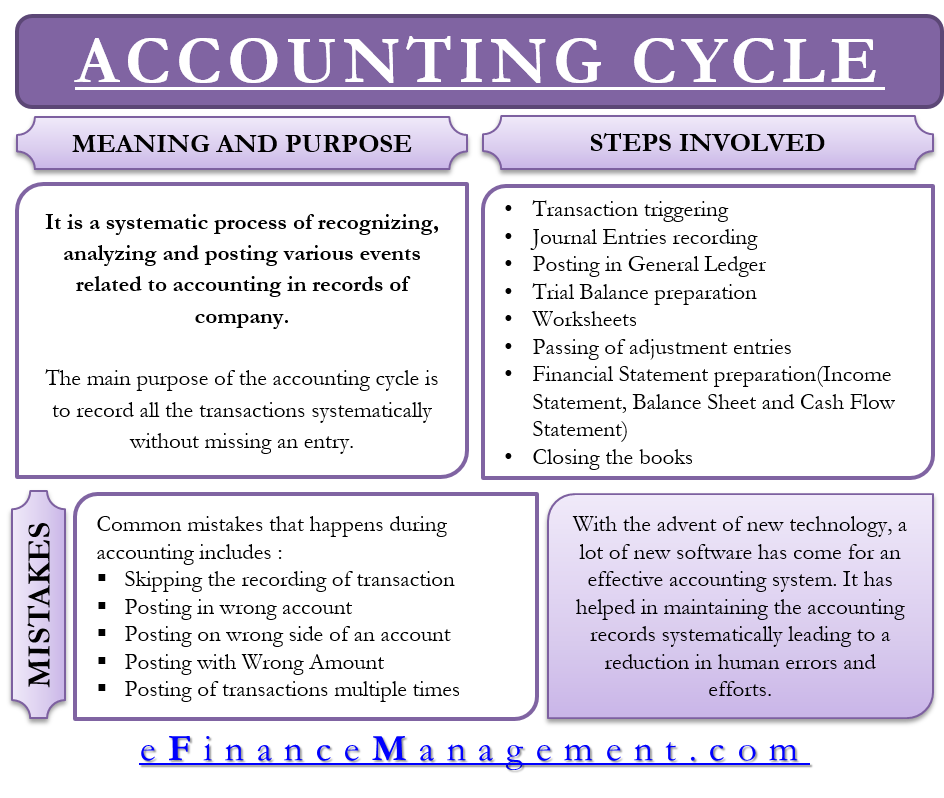

- The accounting cycle is a cornerstone of financial administration, providing a scientific strategy to recording and reporting financial information.

- The amount turns into a debit report to the cash account and credit score to the Gross Sales Income account.

The closing step impacts only temporary accounts, which embody revenue, expense, and dividend accounts. The everlasting or real accounts aren’t closed; quite, their balances are carried forward to the following financial period. These journal entries are often identified as adjusting entries, which ensure that the entity has recognized its revenues and expenses in accordance with the accrual idea of accounting. After posting transactions to the ledger, an unadjusted trial balance is prepared to test the equality of debits and credit across all accounts.

While the accounting cycle supplies a strong framework, it isn’t without challenges. Errors can happen at any stage, whether or not through incorrect journal entries, omissions, or misclassification of transactions. For instance https://www.quickbooks-payroll.org/, failing to adjust for accrued expenses can overstate profitability, leading to deceptive financial statements. Once you identify your business’s financial accounting transactions, it’s essential to create a report of them.

Organizing Data

For occasion, if there was an adjusting entry for recognizing accrued revenues, the accountant would update the relevant income account with the corresponding quantity. Accountants thoroughly review the trial stability to ensure that all ledger entries have been accurately posted, no transactions have been omitted, and there are not any arithmetic mistakes within the calculations. A business transaction refers to any exercise that includes the change of products, providers, or assets, leading to a measurable monetary influence on a company’s financial place. It could probably be a purchase, sale, payment, receipt, mortgage, or any other financial exercise that might be recorded within the accounting system. Accountants play a vital function in this process, guaranteeing that financial statements are prepared with precision and integrity. Below, we are going to delve into every step of the accounting cycle, providing a comprehensive information for beginners to know its significance and implementation.

By eliminating the consequences of sure adjustments, the monetary statements for the current interval are extra similar to these of earlier periods. The assertion of retained earnings additionally exhibits any modifications in retained earnings because of adjustments, corrections, or other elements that have an result on the corporate’s retained earnings steadiness. Since fastened belongings like machinery and equipment lose value over time, adjusting entries allocate a portion of their cost as an expense to replicate their utilization through the period.

To fully perceive the accounting cycle, it’s essential to have a strong understanding of the fundamental accounting principles. You need to find out about income recognition (when a company can document gross sales revenue), the matching precept (matching expenses to revenues), and the accrual principle. Nevertheless, you additionally have to capture bills, which you are in a position to do by integrating your accounting software program with your company’s bank account so that each payment shall be charged routinely.

This permits businesses to provide financial statements that are correct, constant, and compliant with accounting standards like GAAP or IFRS. The unadjusted trial steadiness is modified with adjusting journal entries to appropriate account balances for errors and report bills like depreciation which are normally booked at the end of a interval. The accounting cycle is key for enterprise success as a outcome of it systematically captures, information, and analyzes financial transactions. This process allows businesses to track revenue, bills, property, and liabilities precisely. The preparation of a post-closing trial stability permits accountants to confirm the effectiveness of the closing course of. This process includes transferring balances from momentary accounts, such as income, expense, and dividend accounts, to the retained earnings account.

Integrating these tools along with your accounting software program permits for a clean transfer of expense information into your monetary records. To keep away from knowledge entry errors, implement controls such as double-entry verification, automated validation checks, and periodic reviews of entered information. Providing training to staff on accurate data entry practices and using accounting software with built-in error detection features can help reduce knowledge entry errors. Standardizing the chart of accounts across the group ensures consistency and simplifies financial reporting. A standardized chart of accounts facilitates knowledge evaluation, reduces errors, and enhances the comparability of economic information. This precept aids accountants in assessing the significance of transactions or events for disclosure in financial reviews, it guides several accounting cycle steps.

You can do this in a journal, or you must use accounting software program to streamline the process. The accounting cycle is a process that companies use to track their cash. This journey starts with recording every transaction and ends with reports that show how nicely the company is doing financially. Each entry consists of the date, quantities, affected accounts, and a short description. For instance, a cash journal entry for a $600 payment from a shopper would debit the cash account by $600 and credit score accounts receivable by $600. Sure, small businesses can greatly benefit from implementing the accounting cycle.